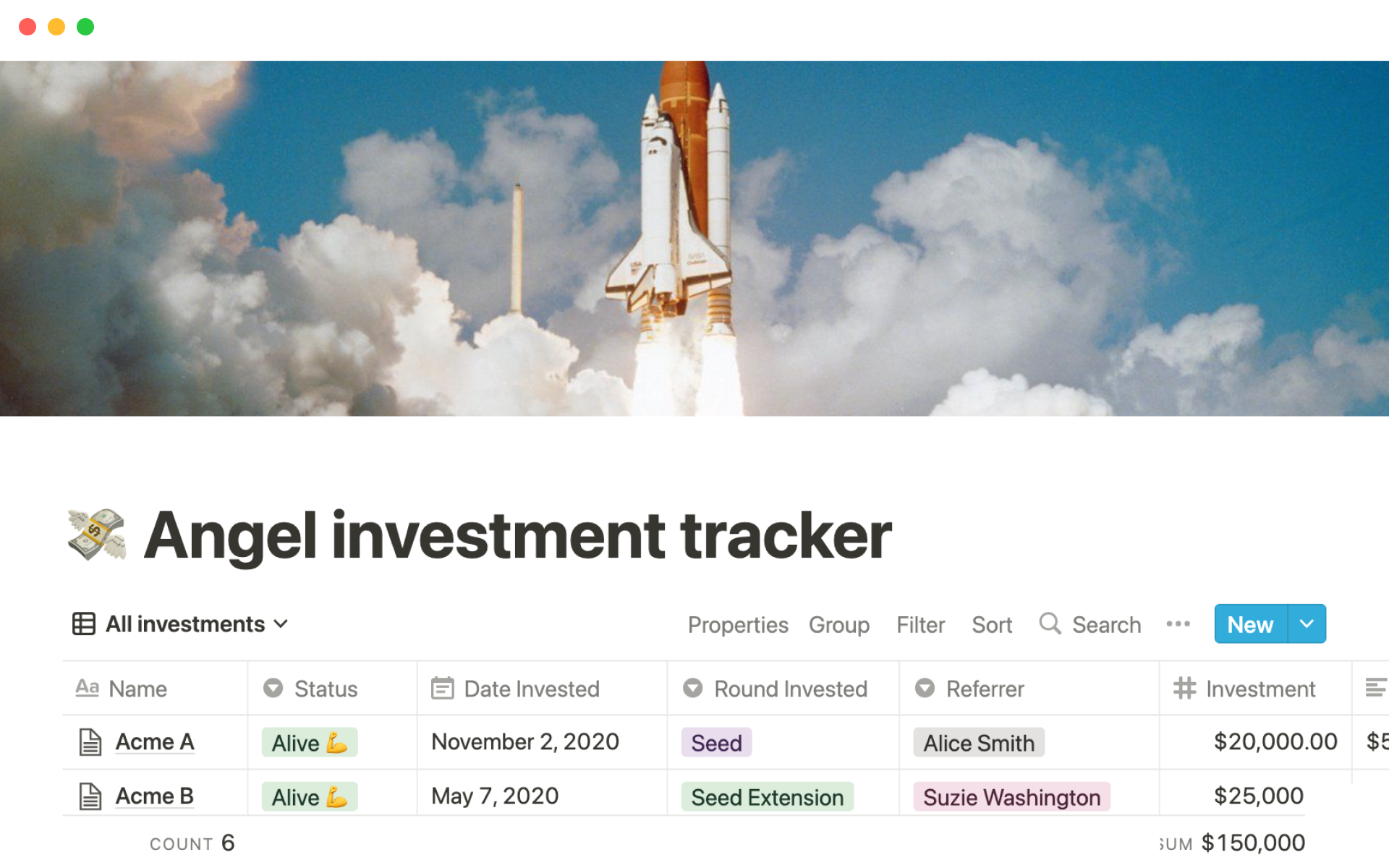

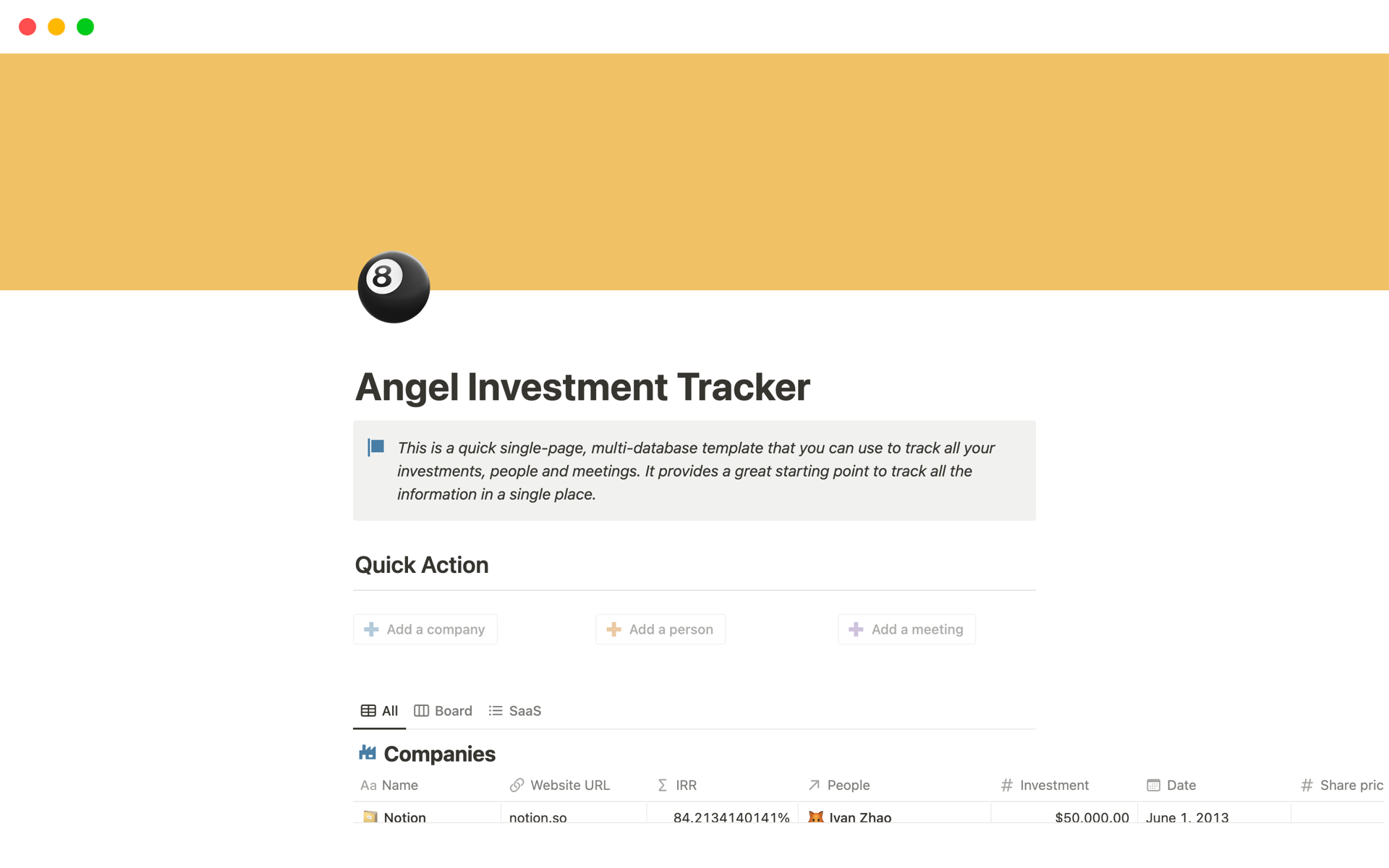

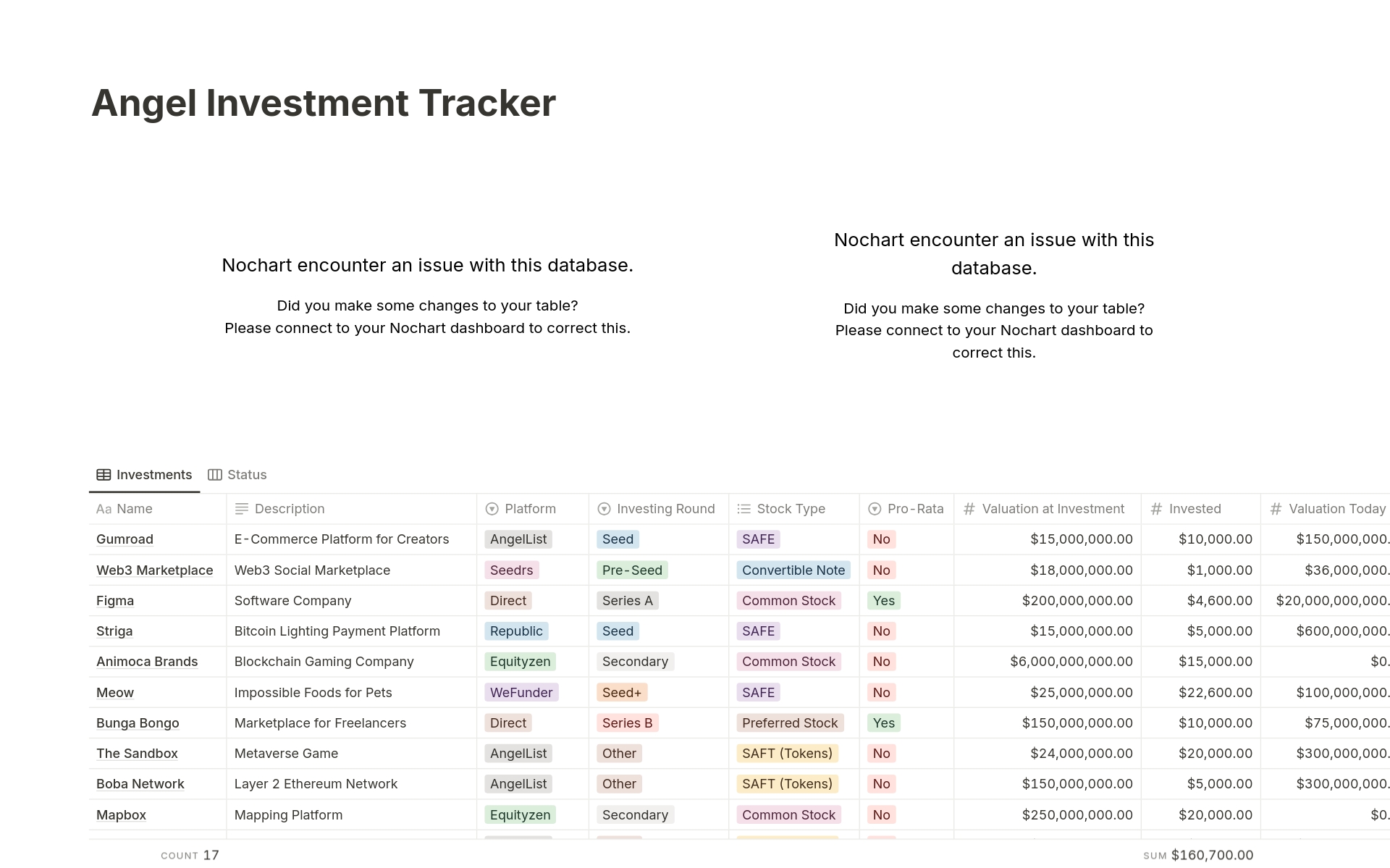

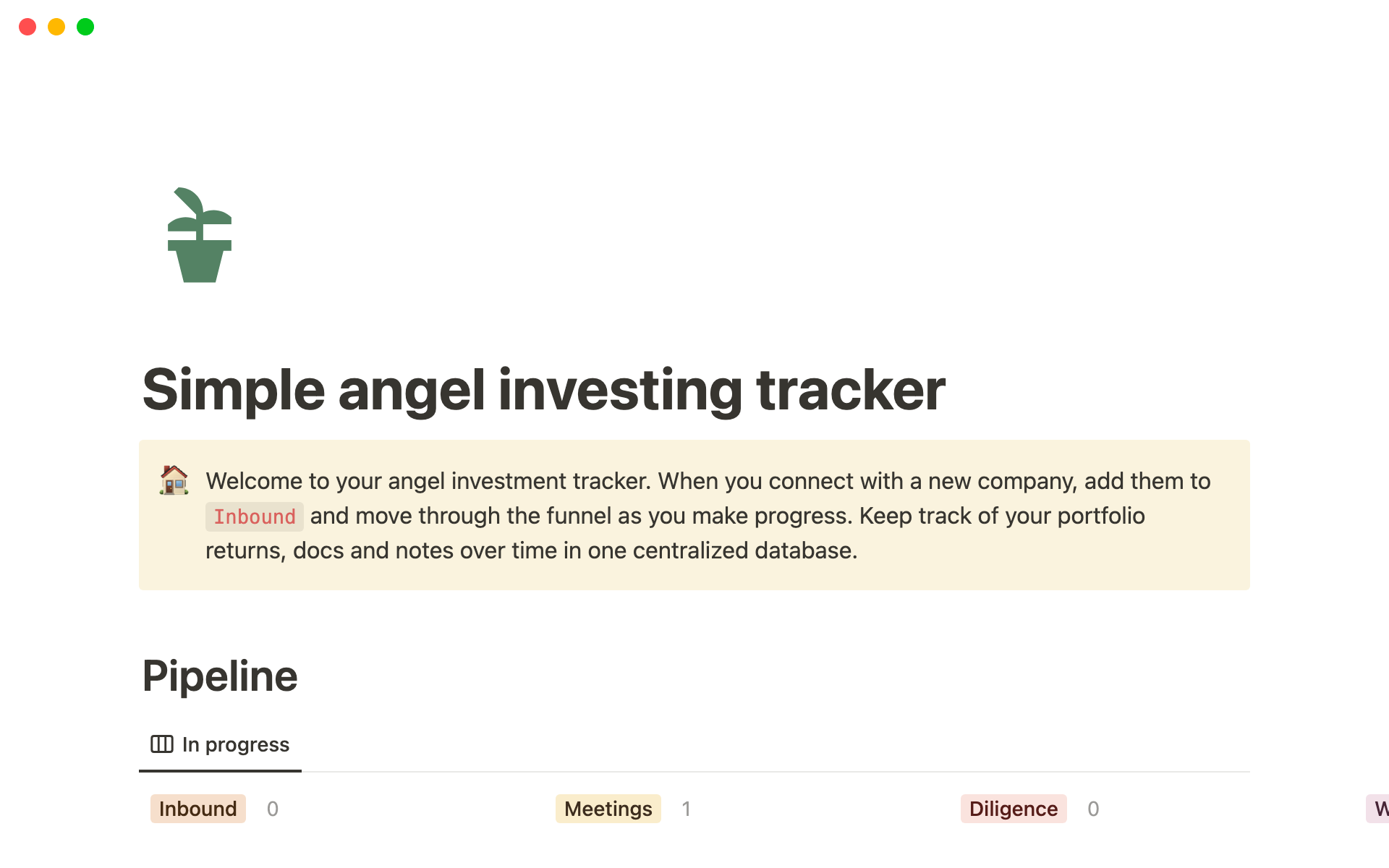

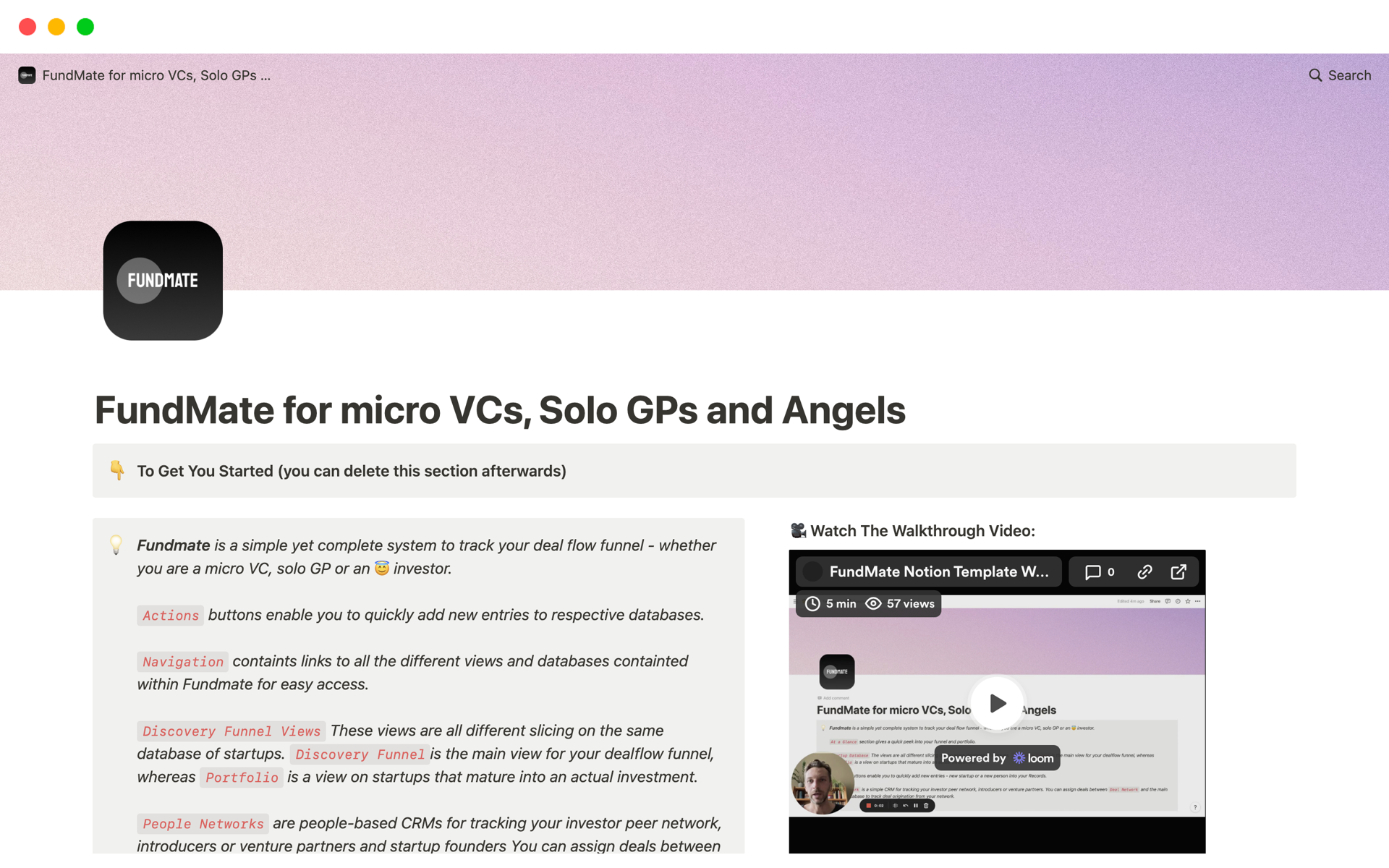

Startup investing is a strategic endeavor that can lead to significant financial returns and the opportunity to support innovative ideas. It requires meticulous tracking of investments, market trends, and the progress of startups. A Startup Investing Notion template can streamline this process by organizing all relevant information in one place, making it easier to make informed decisions and monitor the growth of your investments.

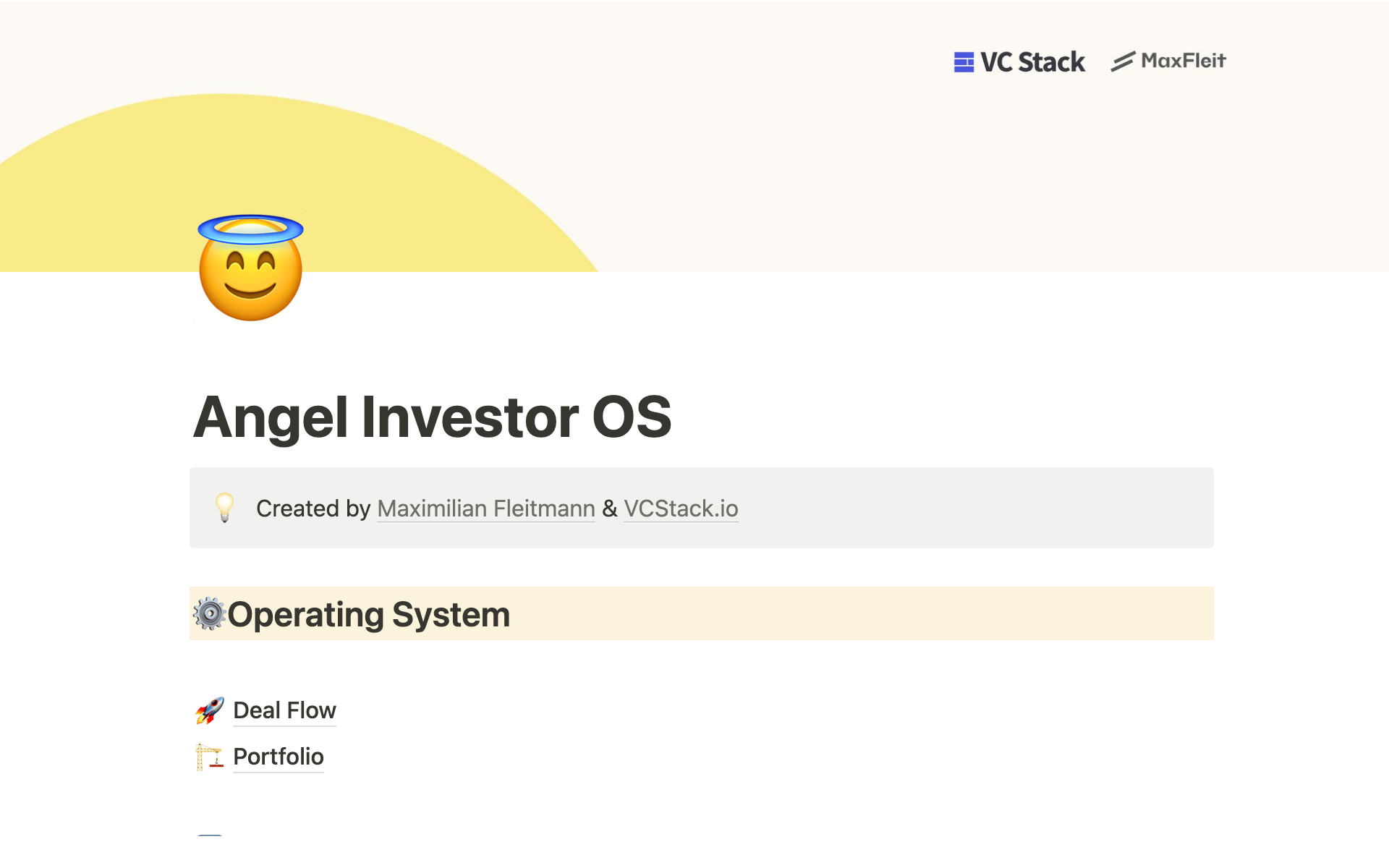

Before you dive into creating your own startup investment system, take a look at these Startup Investing Notion templates below to simplify and enhance your investment management.