Stay on top of your angel investing decisions with Notion angel investing templates. Easily track investments, manage meetings, and take control of your portfolio with ease. Choose from our pre-designed templates or customize your own to fit your needs.

Top 8 Angel Investing Templates in Notion

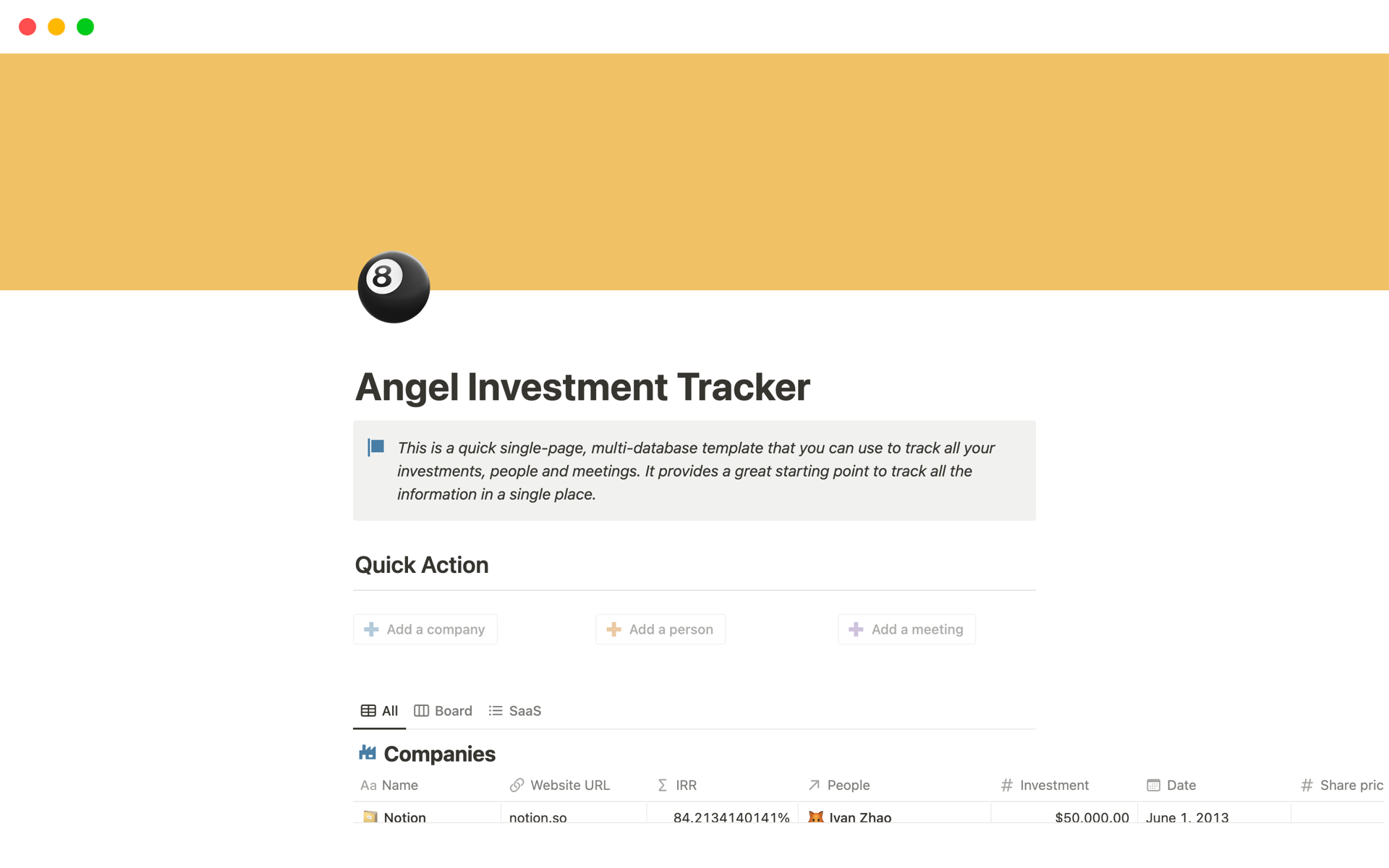

1Angel Investment Tracker

Helps angel investors track their investments over time by giving them a chance to store all updates, memos, funding, etc in a single place. It also has a nifty IRR tracker for how the investments are doing.

2Angel Investor Operating System

Some years ago, I started investing as an angel investor, and the experience has been great. I can meet amazing entrepreneurs worldwide and support them with my money and knowledge.

But at some point, it became a lot of work to manage the deal flow and portfolio companies - especially because I do it at the side.

And till a few months ago, I didn’t have a proper system to solve this issue. But then I sat down and created a full Angel Investor OS in Notion.

👇 What's inside?

- Deal Flow CRM

- Portfolio Monitoring

- KPIs

- Companies

- Co-Investors

- Founders

- Mini Portfolio Page

- Value-Add

- Email Templates

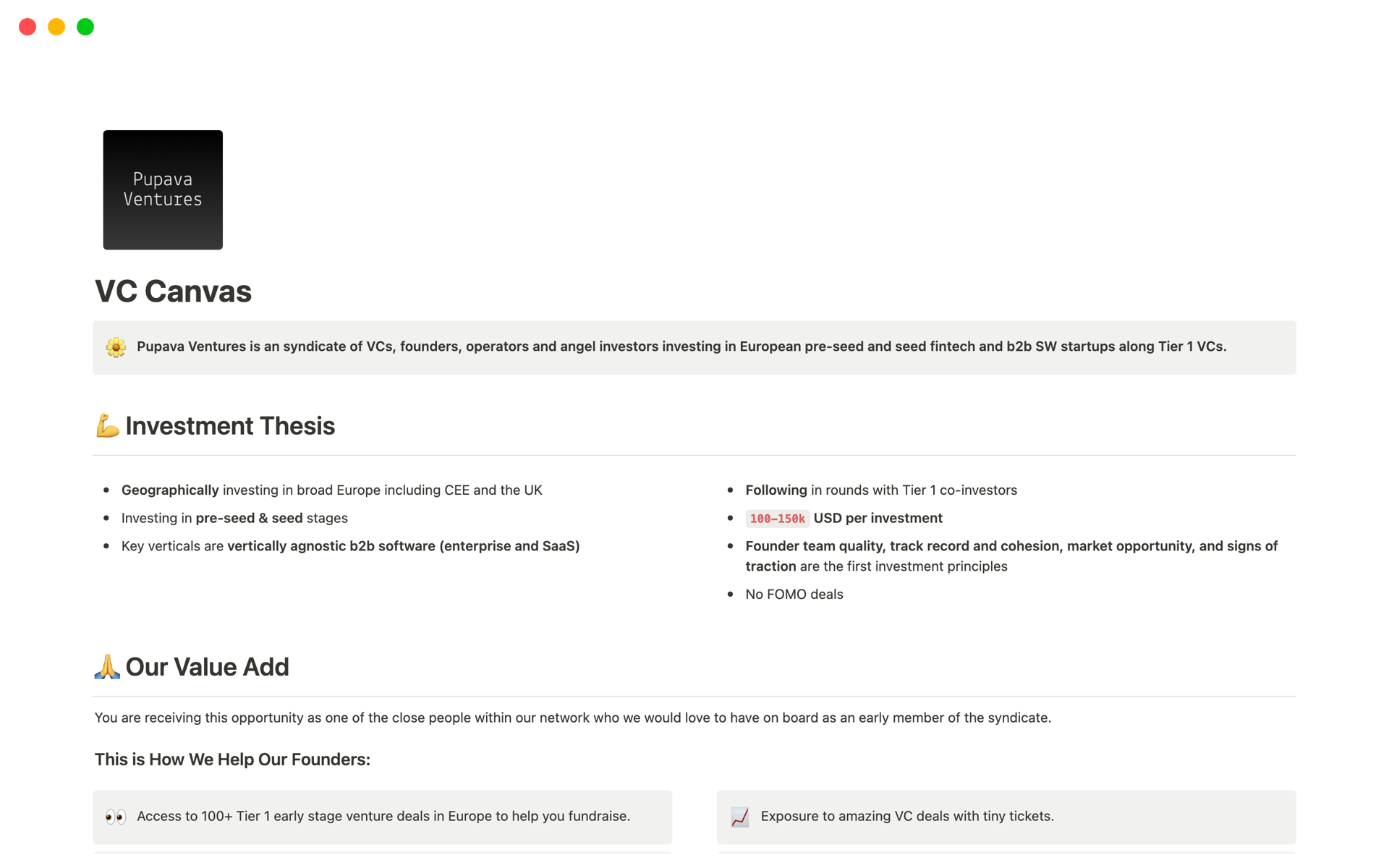

3VC Canvas

Don't want to spend weeks on building a website and rather focus on fundraising or investing? VC Canvas enables you to have online presence in minutes and with no monthly fees or strings attached. Present your team, investment thesis & process, founder FAQs and a lot more. VC Canvas is designed for any micro VC, VC firm, or solo GP looking for a hassle-free solution to establish a powerful online presence.

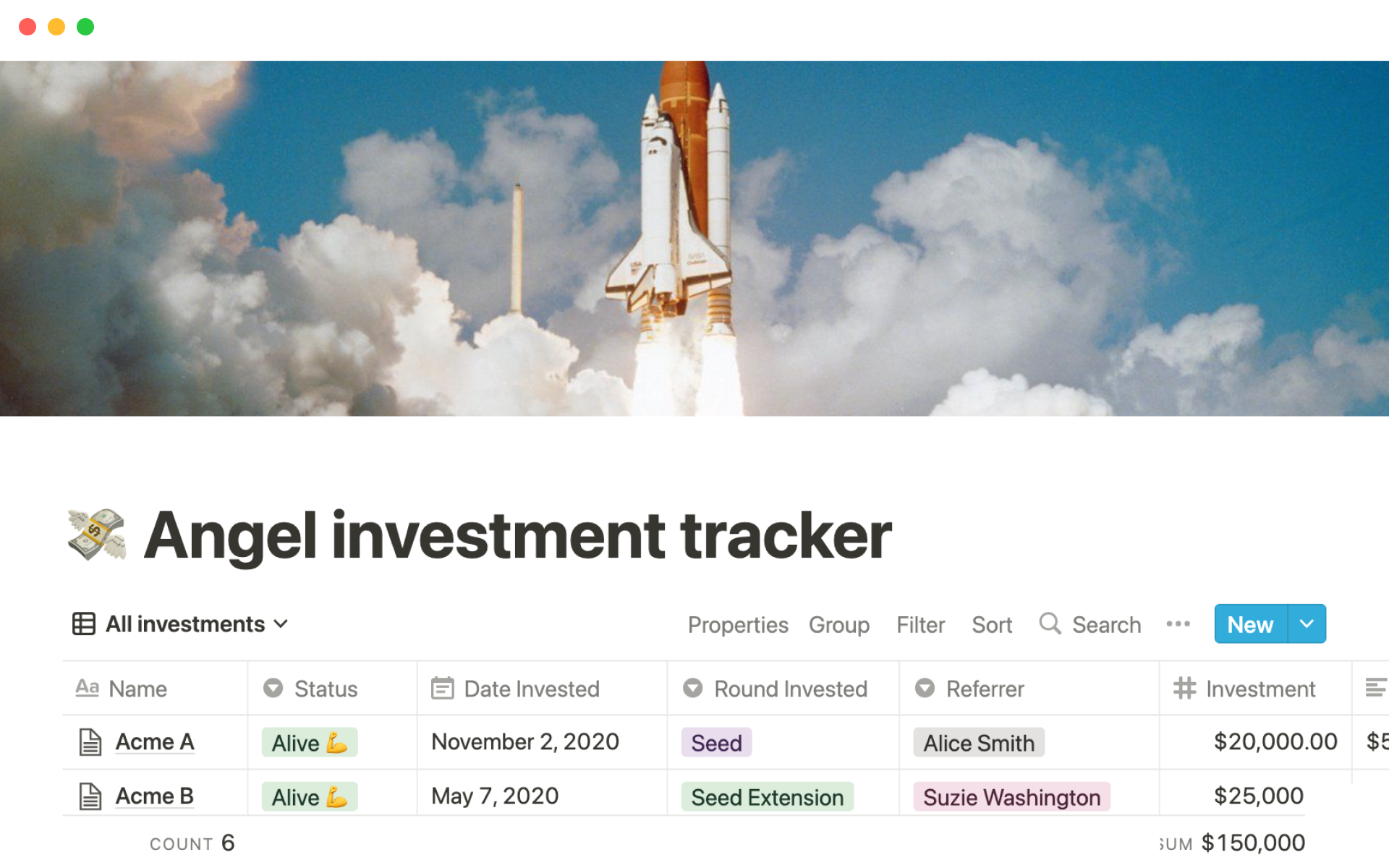

4Angel investment tracker

Angel investing requires careful consideration of a startup’s problem space, market, team, and more. This template consolidates all of your investments, dead or alive, and helps you retain valuable details for making sound business decisions. Use this template to manage your portfolio and coordinate your investment process.

5FundMate - CRM for micro VCs, solo GPs and angels

FundMate makes it easy track all the important parameters of the startup investment opportunities and a place to keep documents, notes and related tasks.

It provides an end to end system for the whole lifecycle of a small VC operation - from an overview of the investment funnel to ability to manage a portfolio of investments made.

FundMate is made based on my experience and designed specifically for angel investors, micro VCs and solo GPs in running their startup investment activity.

6Startup Essentials Bundle

The Startup Essential Bundle is a comprehensive package designed to empower startups in securing investor funding and setting their course for success. It offers an AI-powered Investor Deck template for Notion that simplifies crafting persuasive and impactful presentations, a Financial Model for both Excel and Google Sheets for in-depth financial analysis and planning, and a Brand Strategy Notion template to devise compelling brand narratives and strategies. Each tool in this bundle is tailored to streamline the entrepreneurial journey, fostering an environment of clarity, focus, and strategic decision-making. With the Startup Essential Bundle, startups have the crucial resources to thrive and win over investors.

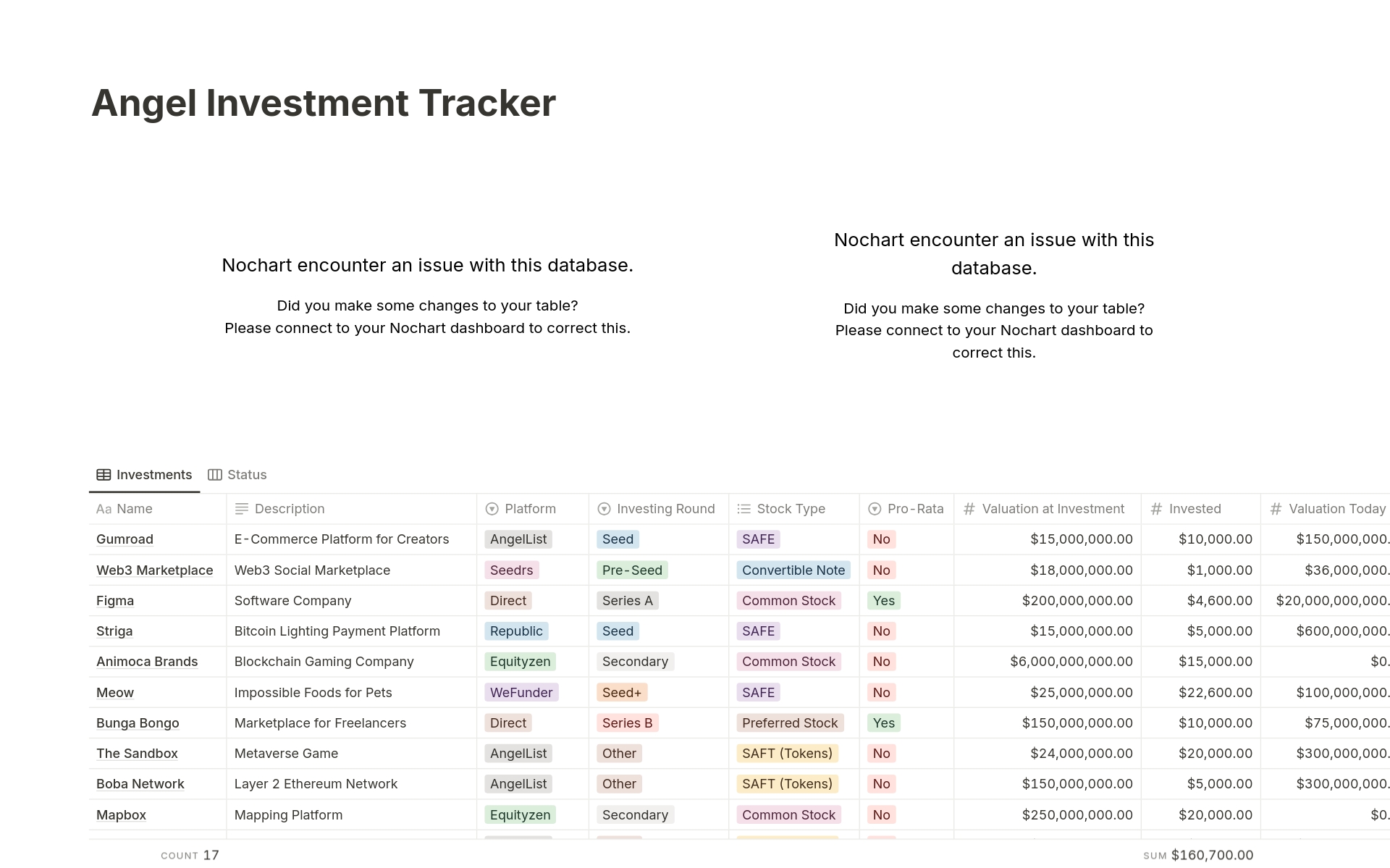

7Angel Investment Tracker

This powerful tracker template for Notion is the perfect way to stay on top of your angel investments. Keep track of the companies you have invested in, at what valuations, how much your portfolio is worth, and much more. This tracker is a must-have tool for angel investors!

Features 💰

- Choose the Round of the deal, the Valuation, the Stock Type, Pro Rata Rights, and more!

- Calculates Unrealized Value and takes Markup into account

- Calculates Profit/Losses and takes Carry into account

- Beautiful charts (via Nochart)

8Simple angel investing tracker

Welcome to your angel investment tracker. When you connect with a new company, add them to Inbound and move through the funnel as you make progress. Keep track of your portfolio returns, docs and notes over time in one centralized database.