Think about your last over-budget project.

It was probably pretty recent, given that it only takes one spending hiccup to spiral out of control. All too often, this leads to failed projects or late deliveries before project managers question what went wrong.

Fixing the problem isn’t as simple as saying, “We’ll just spend less money next time.” But through careful project financial management, teams can proactively solve their budget problems.

What’s project finance management?

Project financial management is the art of overseeing all the money involved in a project, from surplus funds to expenses.

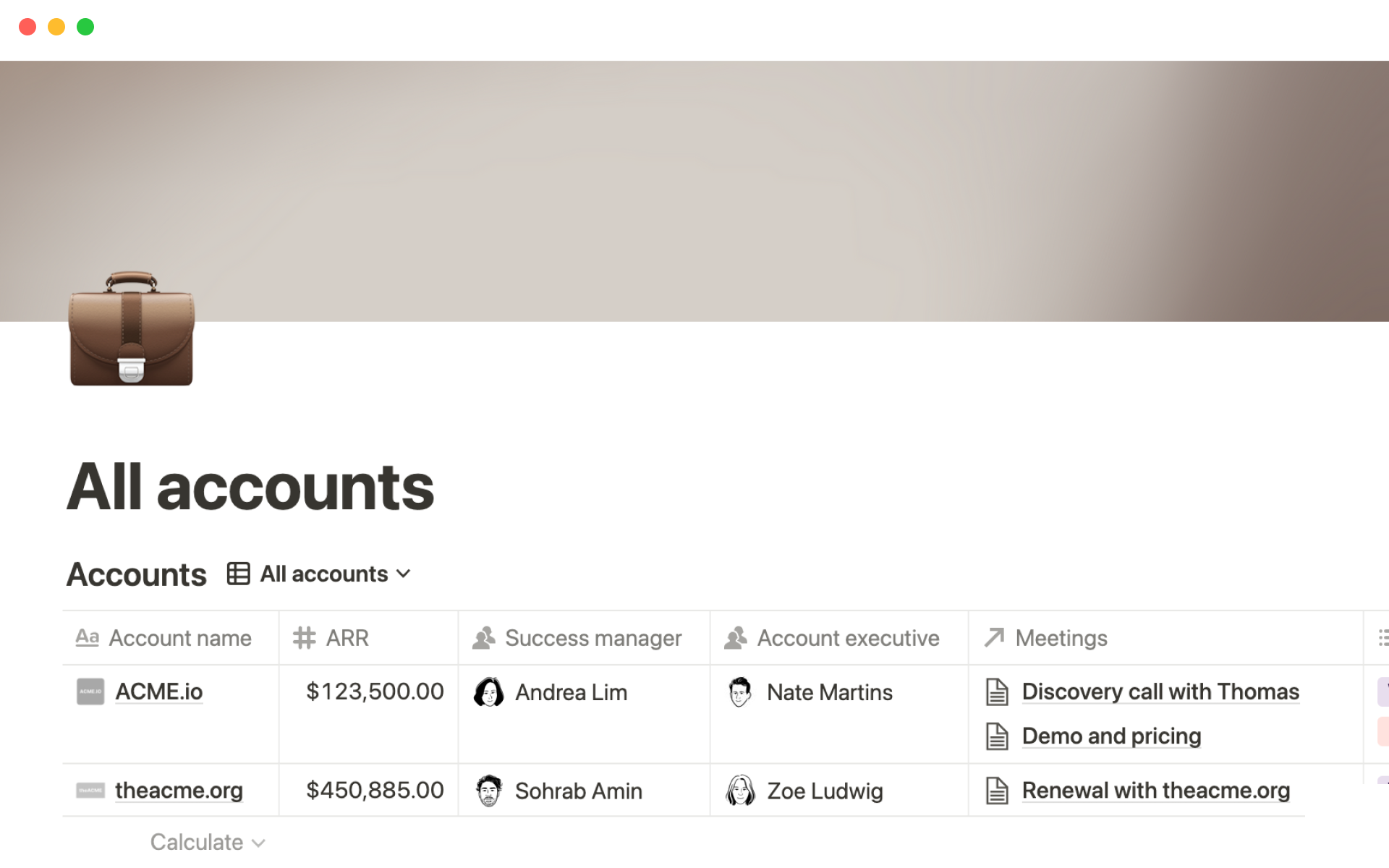

Accounts need monitoring, bills need collecting, and employees need paychecks. And someone must oversee all these financial exchanges, like any expenses or payments received, through every stage of the project lifecycle. In the planning phase, you’ll decide whether that someone is the project manager or another designated team member.

The primary goal of finance management is to guarantee that teams complete the project within the approved budget while achieving main objectives. Accomplishing this goal involves successful:

Planning

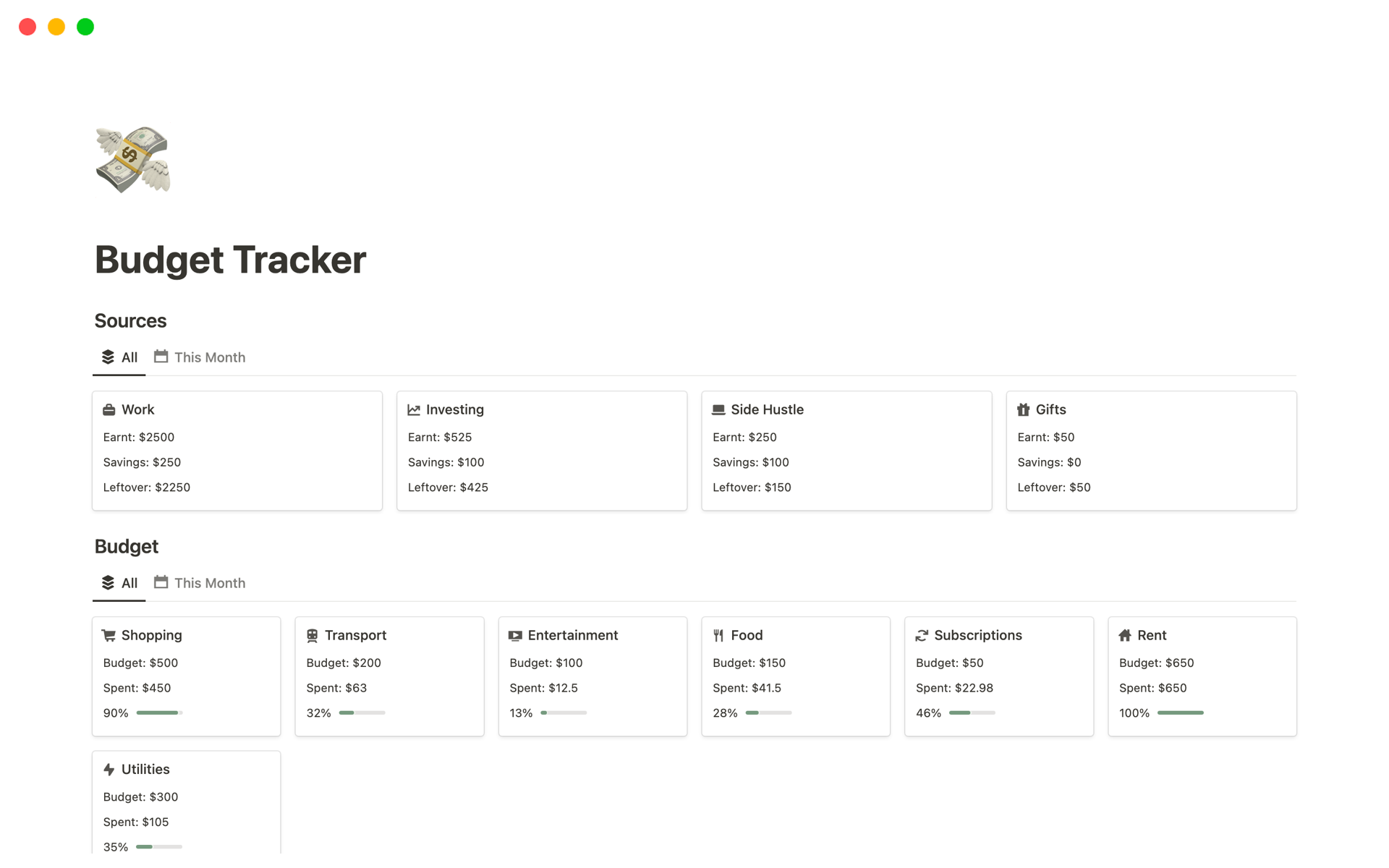

Budgeting

Billing

Accounting

Funding

Expense tracking

Resourcing

The importance of project financial management

Sound financial management enables project managers to optimize resource allocation, manage risks, and make informed decisions based on real-time economic data. It’s the difference between making and losing money.

At the same time, you often need to spend money to make money. Smart investments might lead to short-term consequences while bringing forth new resources and opportunities that will benefit the company for many years.

When implemented effectively, financial management helps the company grow while avoiding common budgeting pitfalls that could disrupt the operation. Let’s say you don’t properly scope how many hours the development team needs to build out a new product feature. Your options are either bringing on a new team member or pushing back the delivery date so the current team has more time. Both options cost you in either the hours needed to add human power to the project or the costly delay of not delivering.

Knowing the potential cost of these hiccups and how to fix them saves you from overspending when fixing crucial issues.

Common challenges with managing project financials

Managing project finances can be tricky since it requires a mix of critical thinking, analytical, and problem-solving skills. To start, teams need to figure out efficient financial management methods, like streamlined accounting and reporting processes. Then, they must monitor and adjust throughout the project, balancing cost savings and quality output.

Here are some of the most common challenges that teams face when planning and managing project expenses:

Unforeseen costs — no matter how carefully planned a project is, unexpected expenses occur and throw the budget into disarray. Fees could result from macroeconomic factors, like economic shifts or natural disasters. And lower-level costs could arise from an unexpected employee departure, procurement mistakes, or legal disputes.

Inaccurate budget forecasting — by nature, budgeting is a tricky practice. It requires predictions about future events, such as costs of materials, labor, and other expenses. If forecasts miss the mark, you might find yourself underestimating or overestimating the budget.

Cash flow management — delays in funding or payment can halt progress, even if the overall budget is accurate. Maintaining a consistent cash flow is tough, especially in projects reliant on milestone-based costs or external funding.

Scope creep — as a project progresses, stakeholders might demand additional features or changes that weren’t initially accounted for. This phenomenon, known as scope creep, can rapidly inflate project costs if not proactively controlled.

Communication barriers — effective project financial management requires clear communication between all parties. Misunderstandings or a lack of transparency can lead to duplicated efforts, missed payments, or misallocated funds, all of which disrupt the financial balance of the project.

Tips to improve project finance management

Project finance management is more than counting pennies. It's about understanding where those pennies go and why. Implement best practices into your processes to keep your budgets on track, so you collect more pennies — and grow your piggy bank.

Prioritize financial planning

Start by examining the project timeline and estimating total project costs, including direct costs like raw materials, labor, and equipment, as well as indirect costs such as overhead, logistics, and contingencies. Ensure you forecast potential cost overruns and unexpected expenses often arising during project execution.

Gather relevant data around performance metrics, market trends, or other pertinent details to project finances. And look at past initiatives, using this historical data for a realistic financial outlook.

Additionally, incorporate revenue projections and examine market conditions, competition, and sales forecasts to better understand your potential revenues.

For better financial forecasting, consider integrating predictive analytics tools like Microsoft Power BI or Tableau. These tools can analyze large data sets to uncover past trends and future costs.

Ensure your historical data is accurate before using it for predictive analytics, since imprecise data can mess up predictions and cause budgetary shortfalls, misallocated resources, and missed strategic opportunities.

Build a safety net

Unexpected costs are an inevitable part of dealing with finances in project management. Allocating 5–10% of your total budget as a contingency fund creates a safety net for those unforeseen expenses.

Creating a financial safety net involves:

Conducting a thorough risk analysis

Taking into account potential cost overruns

Considering delays

Examining market volatility

Looking for other unforeseen circumstances, like employee illness or departure

Make time for project pulse checks

Regular project pulse checks involve routine financial auditing and monitoring of project finances. During these pulse checks, evaluate the elements of your project management triangle:

Project scope

Cost or budget

Time

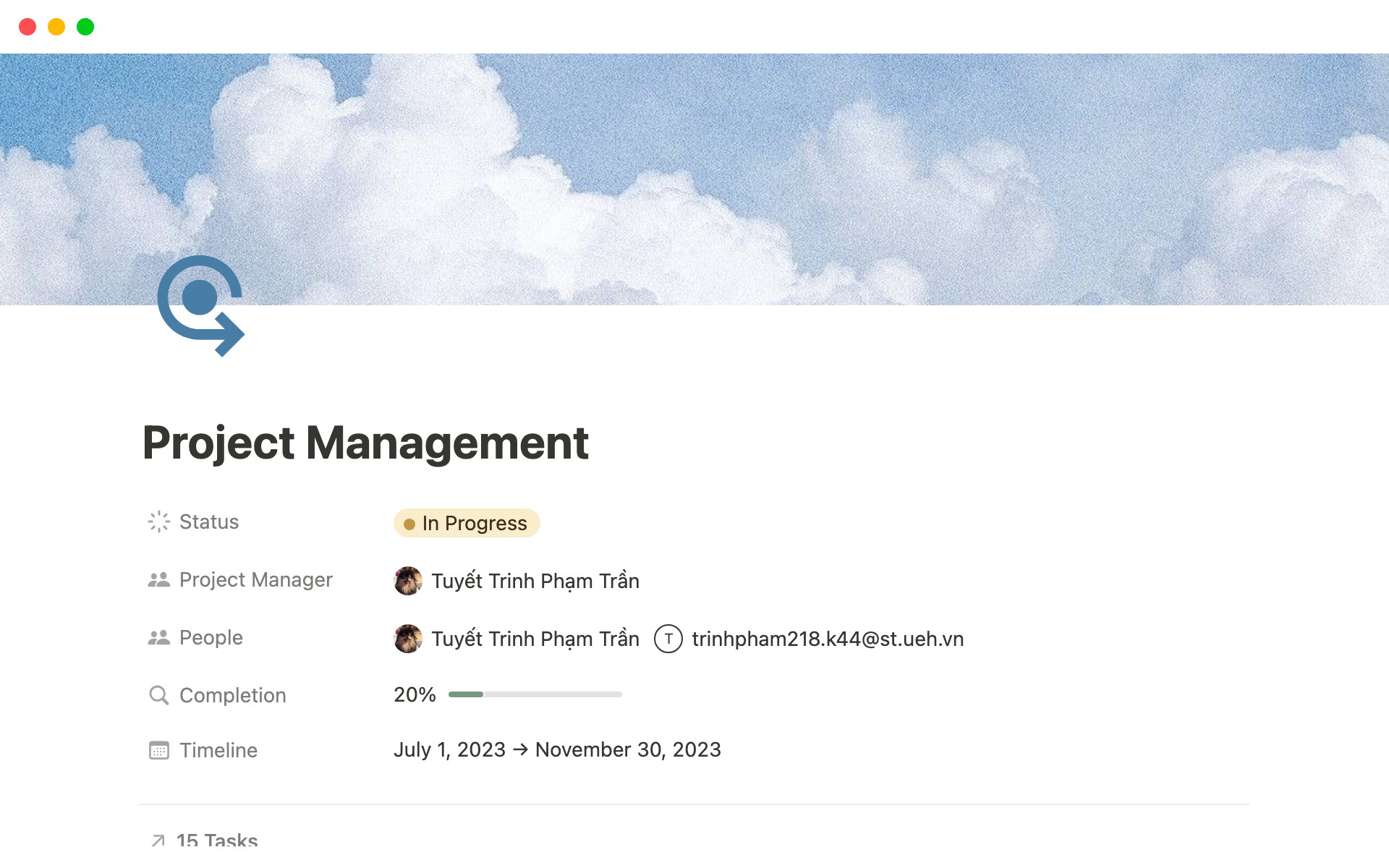

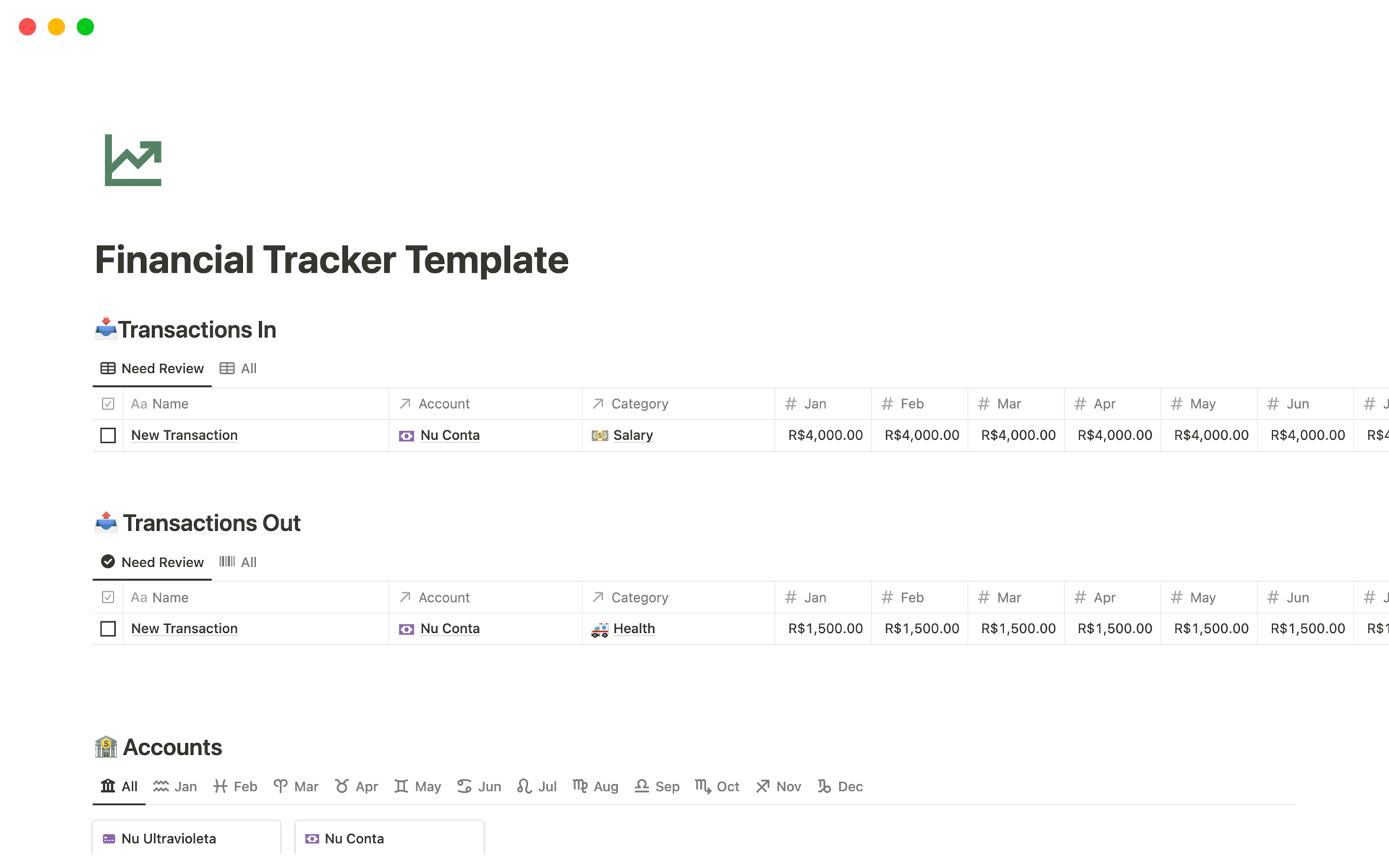

Using a financial tracker template or tools like QuickBooks or FreshBooks makes it easy to view real-time snapshots of financial health.

Always be proactive, not reactive, as course correcting is more manageable than restarting a journey. Frequent financial reviews allow project managers to spot potential economic issues early, adjust plans as necessary, and make informed decisions that support the project's financial health.

Avoid scope creep

Scope creep refers to the unchecked expansion of a project's scope without adjustments to the available time, cost, or resources. It’s a project's silent budget killer and one of the most common pitfalls for project managers, since saying “Yes” to every request might win favor, but it can bankrupt your project.

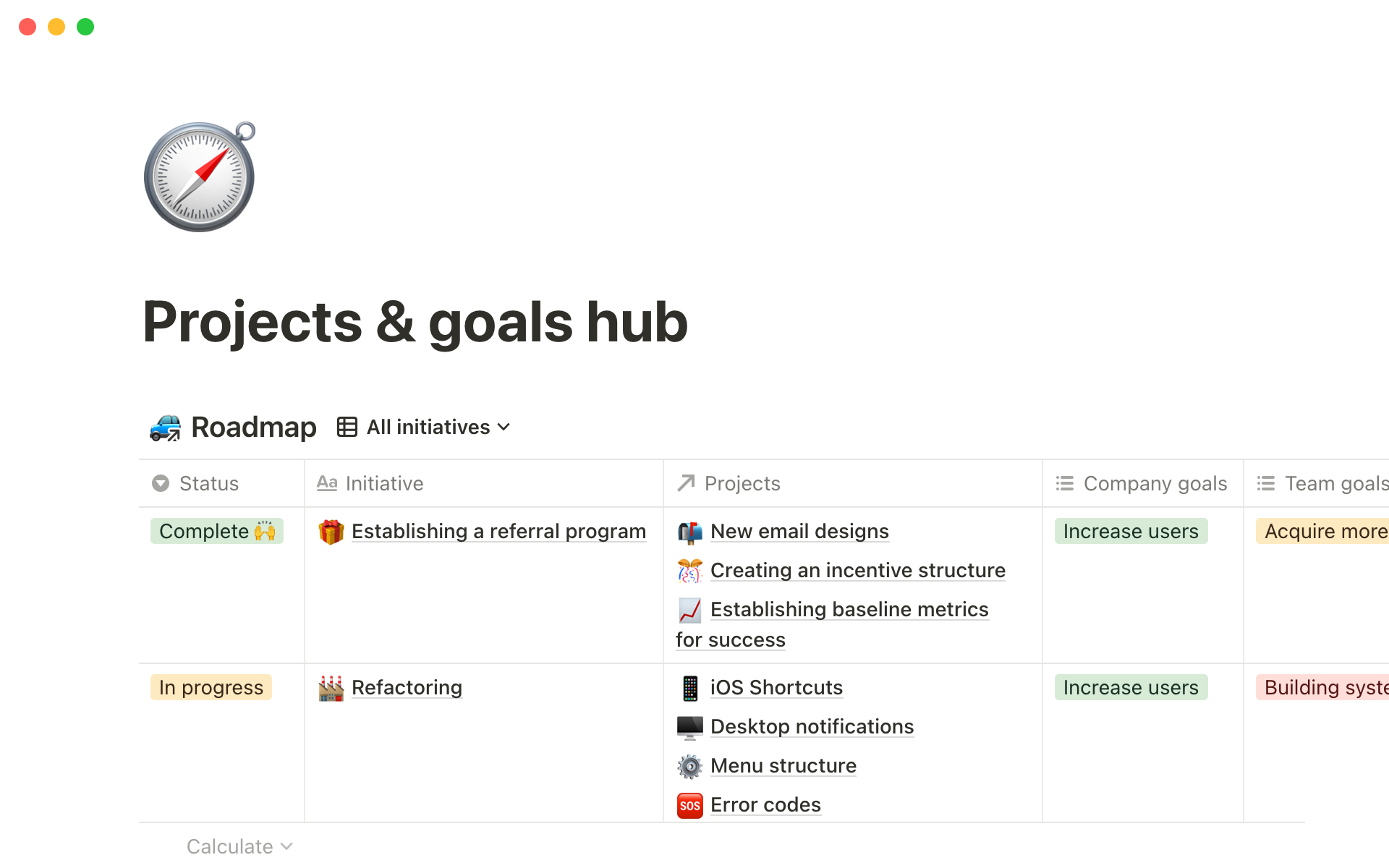

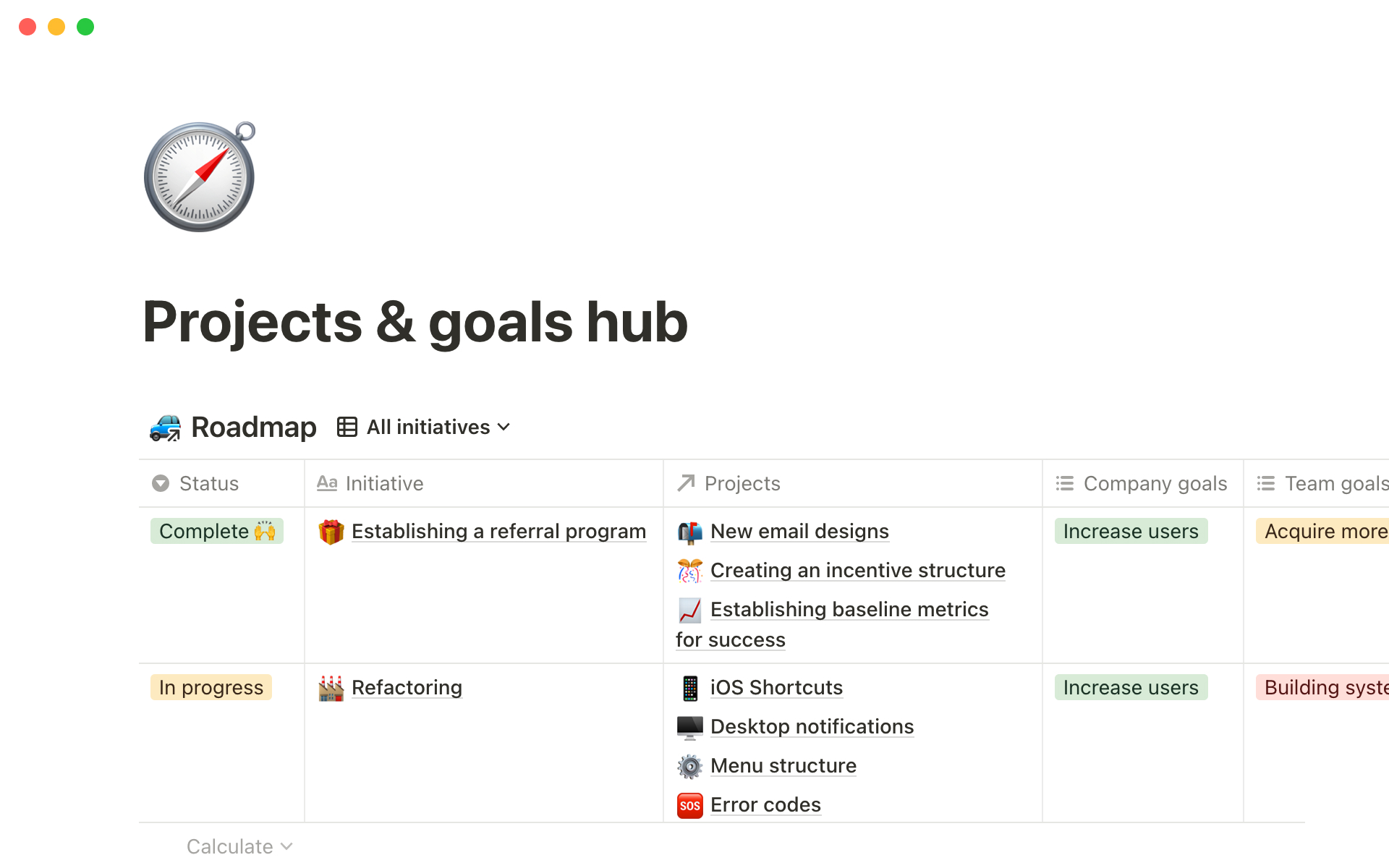

Clearly articulate project boundaries from the start and get stakeholder approval in the planning phase to avoid scope creep. Having a project management software that tracks and announces scope changes keeps the whole team updated.

Use financial management software

Manual tracking is a relic — automation is the future. Modern software automates tasks like finance tracking and billing, freeing more time for strategic analysis.

While spreadsheets have been the norm for decades, most data entry and reporting tasks can now be done by a computer. Embrace the future and make life easier for your accountants, investment managers, and finance department.

Keep financial practices transparent

Regular financial reviews help project managers identify potential issues or budget deviations and implement corrective actions. Studies should assess all aspects of the project's finances, including expenditures, forecasted costs, and overall budget health.

When discussing finances, keep your audience in mind. You want to tailor your language to avoid jargon or confusion, since team updates don’t need the same polish as updates for external stakeholders.

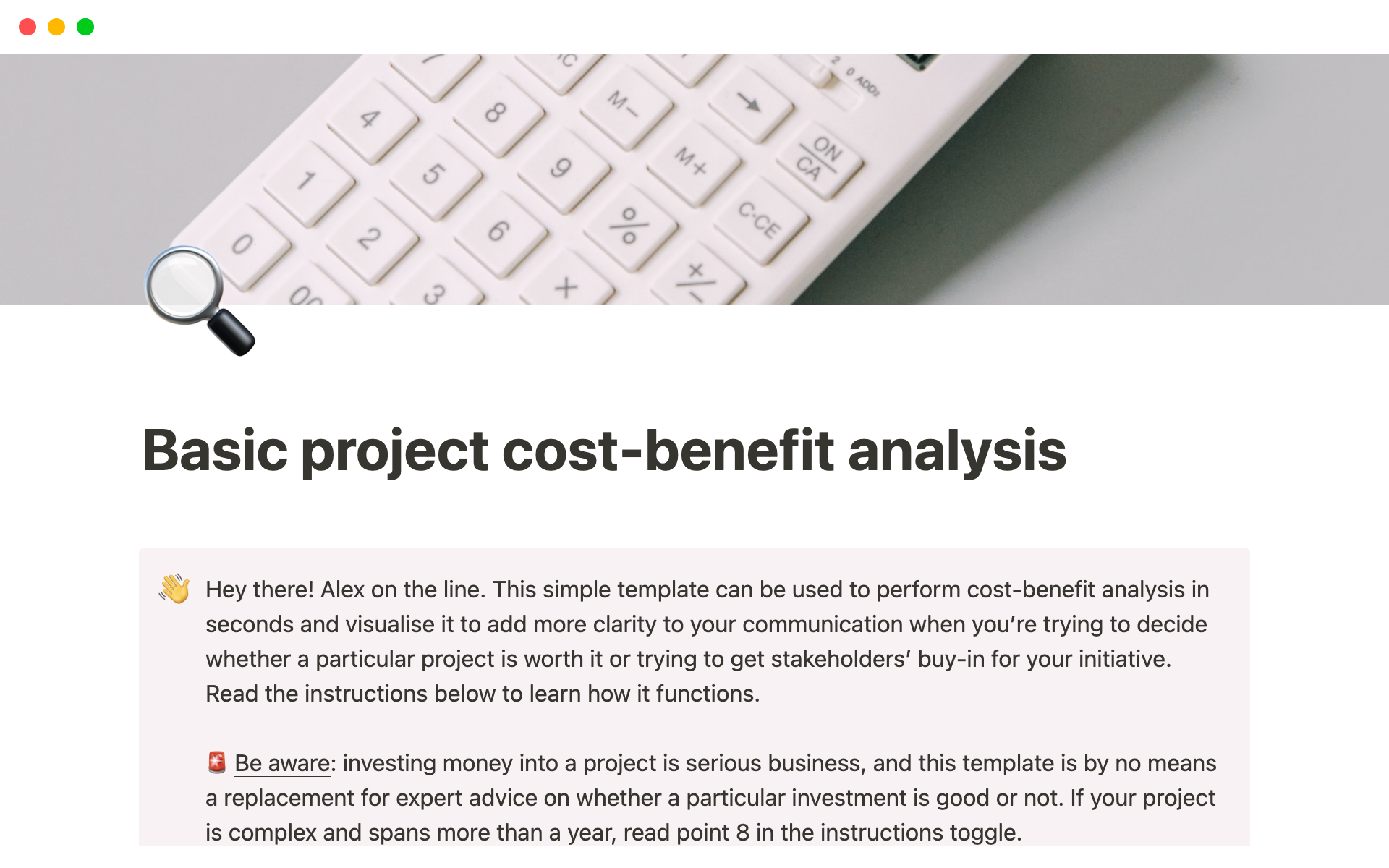

Project financial management made easier with Notion

It’s easier to manage finances when your data is organized and easy to read. Many project managers use Notion’s pre-defined finance tracker templates to monitor their spending and stay within scope. Get started with Notion today to get your budget and business on track for upcoming projects.