<aside> 💡 At Credix, we’ve recently rolled out smart contract-owned wallets (SCOW), making investing in our credit products as easy as sending USDC from your exchange of choice — no more need for web3 wallet solutions and custody infrastructures.

</aside>

Our mission is to connect institutional investors with unique credit opportunities in Latin America, building on the most advanced technologies to achieve scale, and unlocking risk-adjusted returns through robust risk management and structuring capabilities.

Building on the most advanced technologies entails using blockchain technology to enable integrated accounting, settlement, and business logic — all in one atomic transaction. Hereby, we solve the reconciliation issue in financial services and eliminate manual interventions and errors.

The downside of building on blockchain technology is the need for a new kind of operational infrastructure to enable smart contract interactions. There’s a need for wallets to approve transactions and custody solutions to store tokens in a safe manner. For our investors, mainly large institutional funds and asset managers, this is a whole new paradigm. The majority is getting comfortable with the use of stablecoins and smart contracts for efficiency gains, yet setting up a wallet- and custody infrastructure raises eyebrows and slows down the onboarding process.

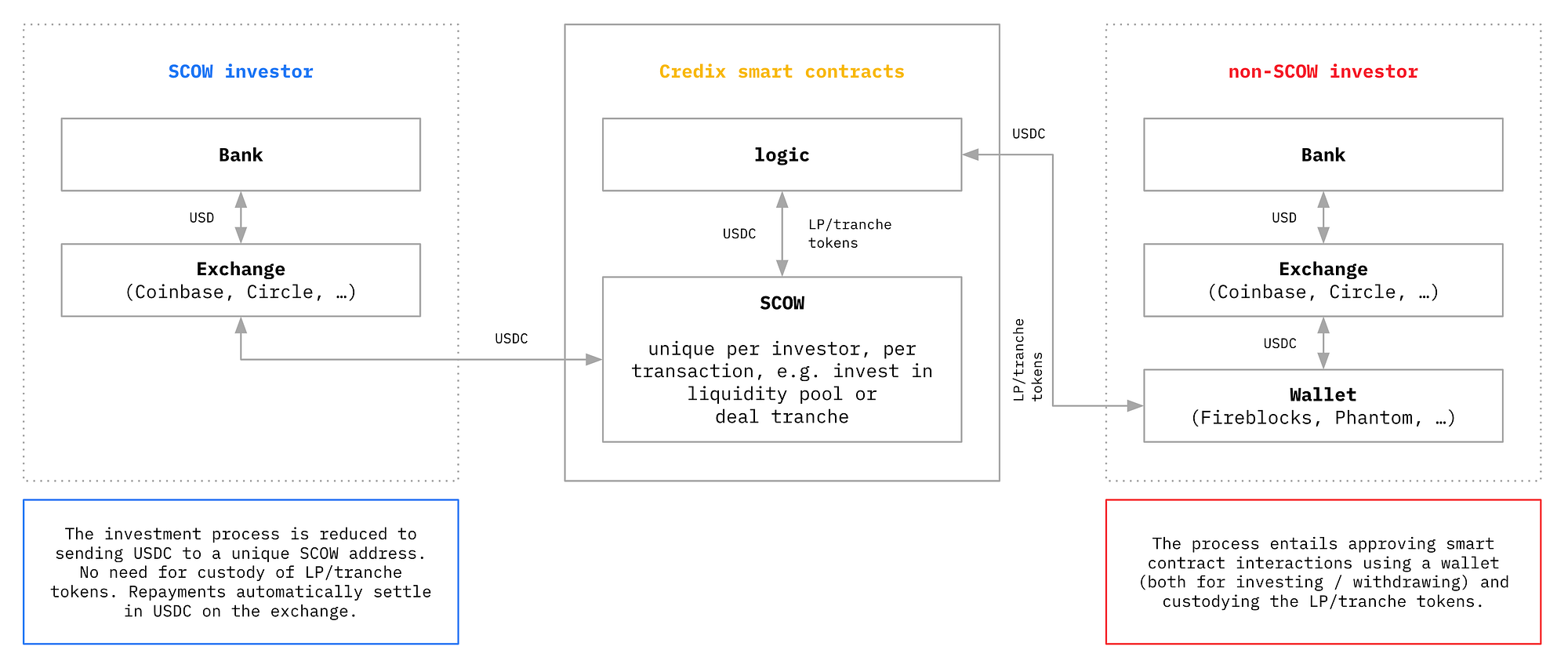

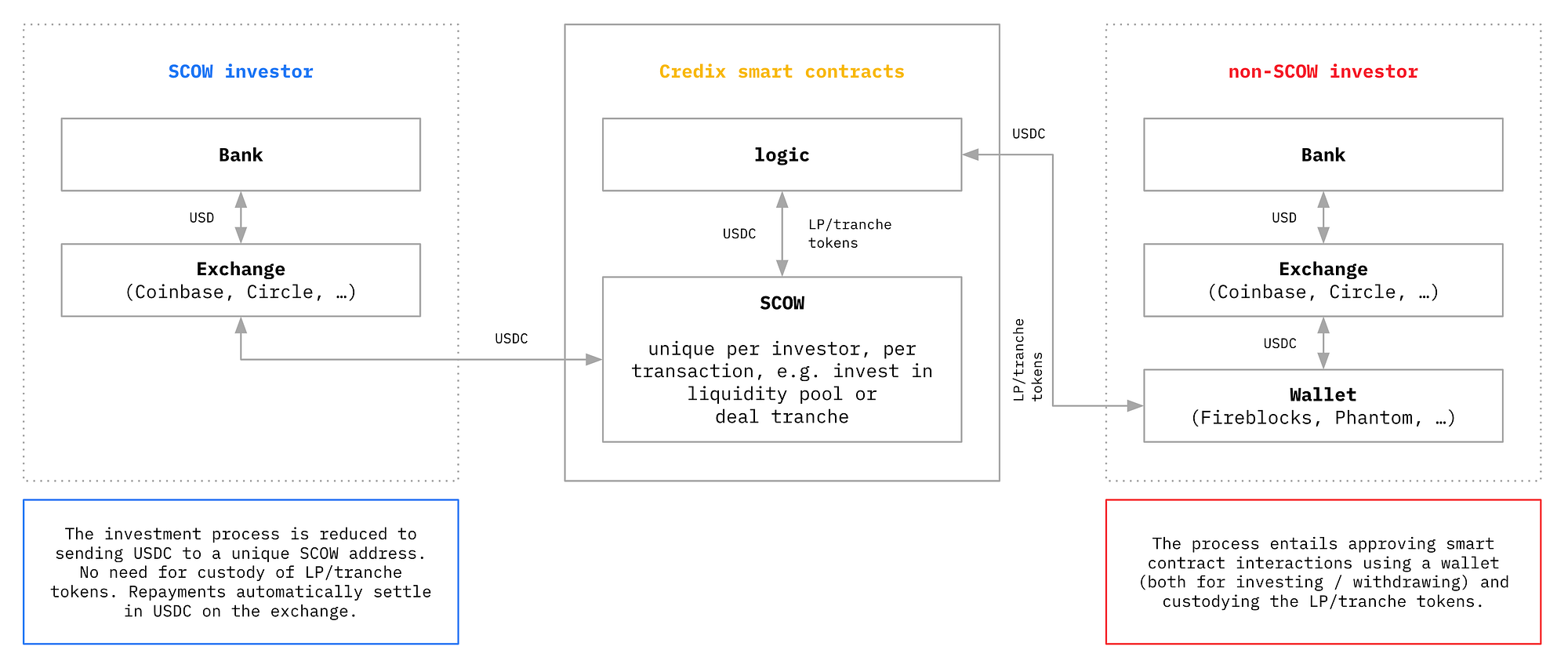

You can think of a SCOW as a deposit address, with a hard-coded route for money flows. You can send funds from e.g. Coinbase, Circle, Fireblocks, etc. to this address. Once the funds hit the SCOW, it automatically invests in the investment opportunity for which the SCOW was set up. Lastly, the SCOW also stores the exchange address of the investor, which is used to send repayments, so they settle on the investors’ exchange.

The below diagram shows the money-and-token flows for a SCOW investor (left) and non-SCOW investor (right).

A similar setup is being used for the counter-party of the transaction. Once a deal is fully funded, the principal is sent to the exchange of the borrower. For deal repayments, an on-chain collection account is set up to which the borrower can make repayments. All without the need for a wallet.

In summary, SCOW brings a variety of improvements to the transaction flow: