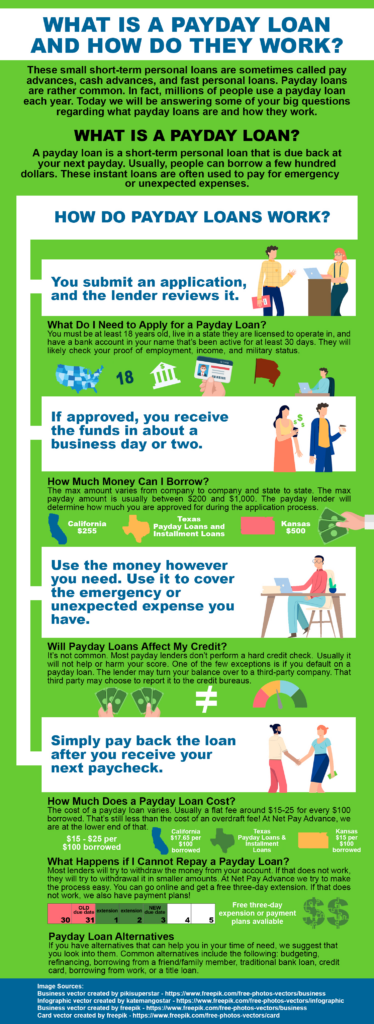

Lots of payday fundings are due in one swelling sum settlement. Some cash advance funding lending institutions likewise enable the money borrowed to be settled in installations.

A $15 fee per $100 obtained is rather regular. A $15 fee on a $100 car loan may not seem like a lot. Yet on a two-week loan, that exercises to an yearly portion rate (APR) of virtually 400%. Cash advance are among one of the most expensive sources of consumer credit history.

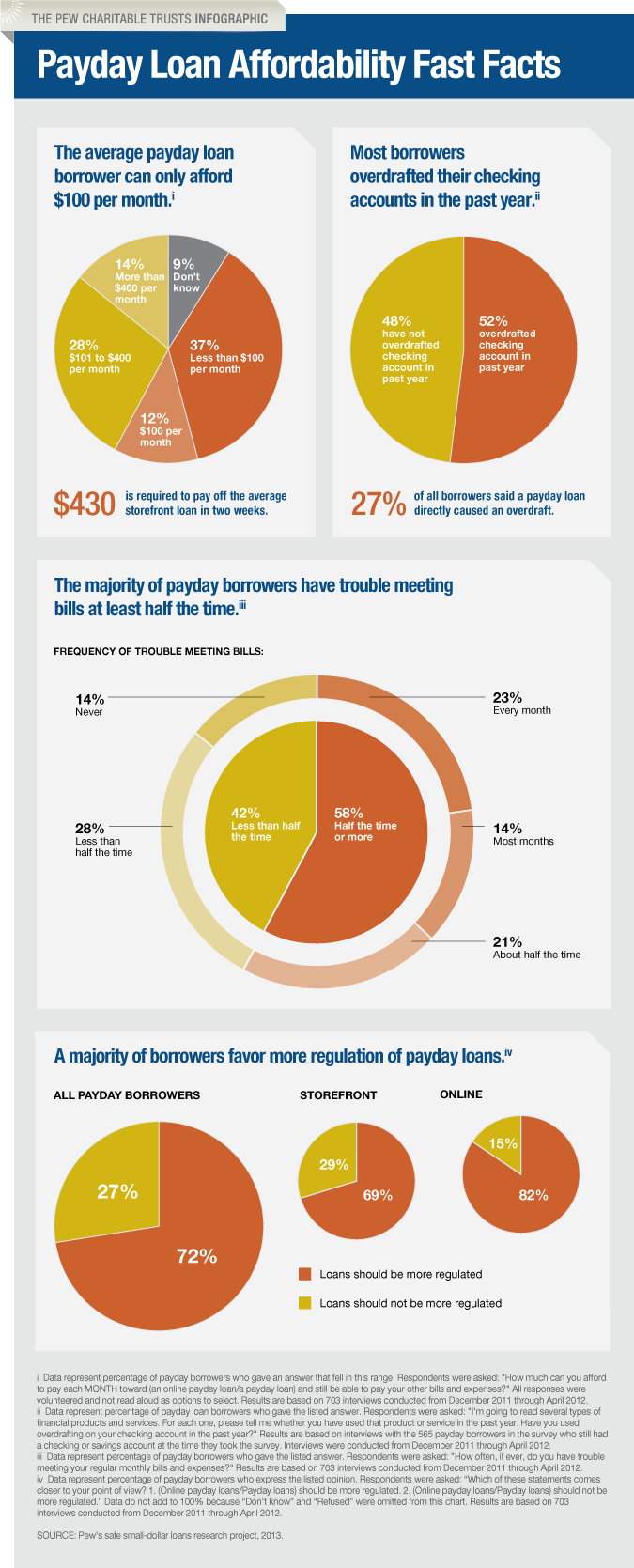

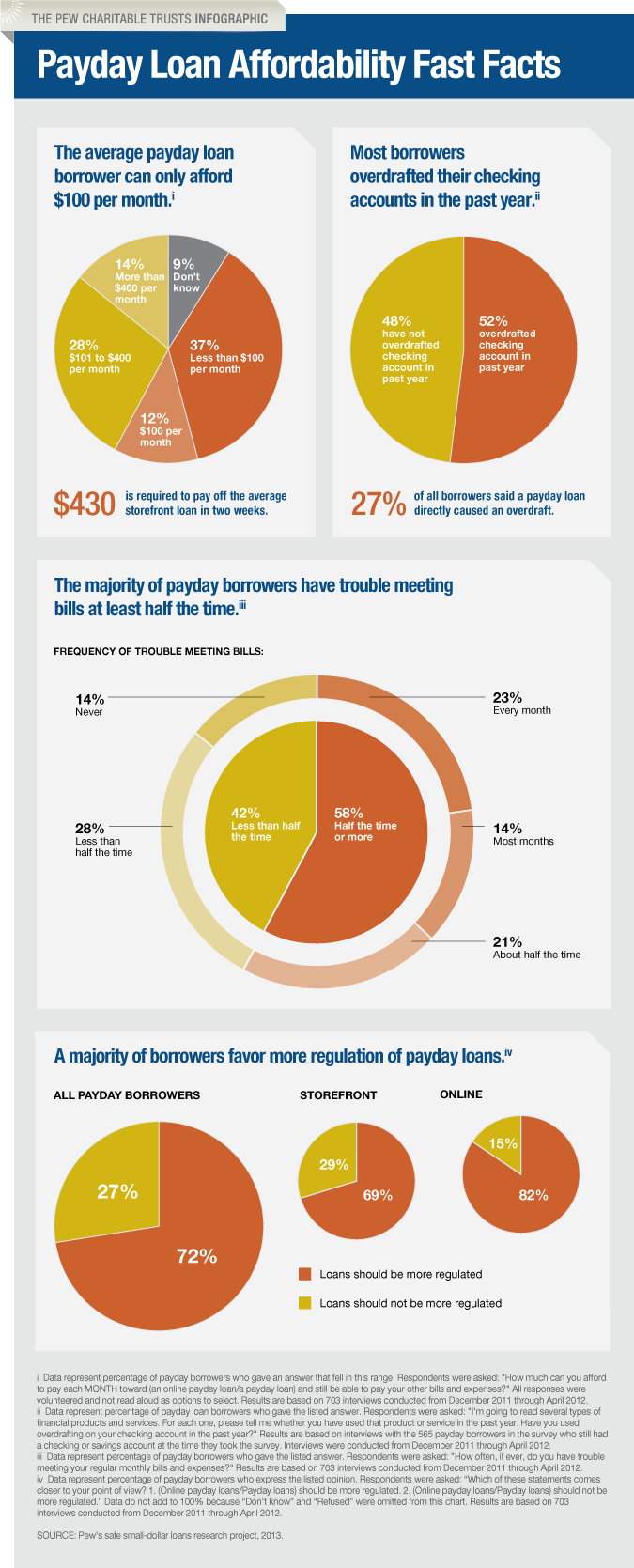

17% as of February 2022. For a 24-month individual lending, the average APR was 9. 41%, according to the Federal Get. Pro Pointer Cash advance financings are outlawed or seriously restricted in 18 states and also the District of Columbia, according to The Church Bench Charitable Counts On. Other states have differing degrees of safeguards.

That means Amy needs to come up with $300 fast. So she goes to a shop payday lender and gets a $300 financing this month while she finds out how to address her monthly deficiency. To borrow $300, Amy has to pay a $45 financing charge. That does not sound like a great deal -

.

That means Amy is paying an APR of almost 400%. But when the funding comes due, Amy does not have $345. The cash she obtained went toward her greater rent and also daycare expenditures. So she pays a $45 cost to roll over the lending. She now has actually spent $390 on her $300 funding.

Numerous monetary institutions will also bill you a cost. At the extremely least, you can stop the lender from taking money you require for fundamentals, like rent or food. New Payday Loans. Keep in mind that when you apply for on-line cash advance, it's typically difficult to tell if you're using with a real lending institution or a lead generator that sends your details to loan providers.

Some states need loan providers to use borrowers a payment plan without billing additional fees. In various other states, loan providers should permit battling borrowers to go into a repayment plan, yet they're permitted to tack on extra charges. Despite your state's law, it's frequently in a loan provider's rate of interest to collaborate with you.

Check Cash Payday Advance Loans

.

An additional option is to inform the lender you're so overwhelmed by bills that you're thinking about insolvency. Many lending institutions are willing to jeopardize in this scenario since they recognize it's likely they would not obtain anything in personal bankruptcy court. If you're bewildered by payday advance or any kind of other type of debt, credit scores counseling is an excellent alternative.

Also though payday loan providers call this fee a cost, it has a 391% APR (Yearly Percentage Price) on a two-week funding. When the lending institution makes the car loan he should tell you in writing exactly how a lot he is billing for the lending and also the APR or rate of interest rate on the funding.

You can only have one payday car loan at a time. That car loan must be paid in complete prior to you can takeout another. When the loan provider makes the funding he will have to put your details right into a data base utilized just by various other payday loan providers and the state company that sees over them.

If you still owe on a payday advance loan as well as go to one more loan provider, that lending institution will certainly check the data base and by legislation have to refute you the loan. Once you repay your payday advance loan, you can obtain a brand-new one the next organization day. Payday Loans Online. After you get seven cash advances in a row, you will need to wait two days prior to you can takeout a new funding.