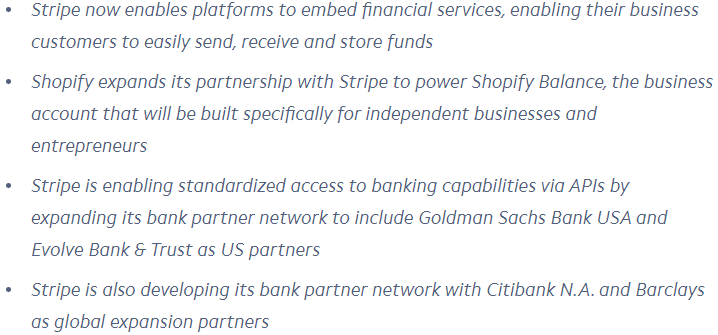

On December 3rd, Stripe announced that they are introducing Stripe Treasury, an API for their customers to manage their funds more easily.

Source: Stripe Newsroom

I was excited to hear this news because in my previous article, ‘*Upcoming fintech or a conventional bank*?’ I had a view (a relevant section captured below) that for a fintech to replace a conventional bank, it would need to build a one-stop solution for consumers.

In capturing this vast market, the future will unfold in one of the following two ways: 1) a conventional bank acquires and integrates a slew of fintech companies, essentially becoming a giant fintech company themselves OR 2) a massive winner in the fintech industry acquires other fintech companies in different verticals and offer the one-stop service. Although the likely scenario would be the former (because it is the incumbent and it already offers a one-stop solution), I think the latter still has a good chance of happening.

As stated in the first point in the excerpt, my anticipation for the conventional bank acquiring promising fintech companies and offer the technology to their existing customers. This to me seemed more feasible because it was difficult for me to visualize how any single fintech company would build a company that can compete/threaten the conventional banks both in terms of a scale and breadth. But the introduction of Stripe Treasury shows that I may have been wrong (or even underestimated the fintech companies) and that the industry, specifically Stripe in this case, is heading towards a bigger and smarter direction than I had imagined.

In this regard, the introduction of Treasury service shows three things: 1) the entire consumer financial industry can be disrupted without seeing the conventional bank gobbling up fintech companies, 2) an introduction of a whole new financial ecosystem on the internet, and 3) potentially ****make banks fully replaceable ****by becoming the de facto network on the thriving e-commerce industry, similar to how the internet has become the de facto of today’s online world.

Like it or not, no one can live without the financial system. It is the medium between our human needs/desires and efforts to obtain those needs/desires. For instance, we get paid for work that we do and spend the money on things like food and entertainment. In the middle, there is a financial institution we call ‘the bank’ that enable this exchange or transformation.

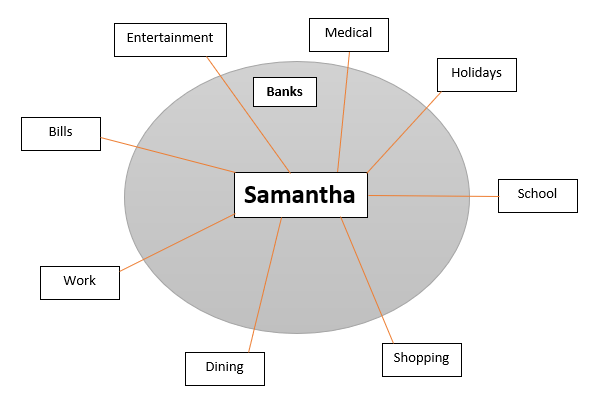

Figure 1

As depicted in Figure 1, it is impossible to carry out our daily lives without the banks. Sure there are internet banks and online payment systems that have started to pop up and scale in many parts of the world but the truth is that too many of us still rely heavily on the conventional banking network. In other words, the network effect of the conventional bank is too large which makes their customers very sticky. This is also one of the core reason why I had anticipated that the conventional banks had a better chance at winning the battle with fintech companies because the CAC would prove to be too costly for the fintech companies, even with the backing of deep-pocketed VCs.

Stripe, however, whether intentional or not, started as a payment processing company which allowed them to avoid the high CAC of acquiring the end consumers. Instead, they focused on targeting the increasing population of those who are building E-commerce stores. They also correctly decided that they should build their product for the web developers and not necessarily for the business owners because the developers are the ones carrying out the job. Hence, during the early days, Stripe was, and still is, the preferred choice among the savvy web developers (mainly for their tech-friendly APIs and breath of features) and was able to break into the market where PayPal had large brand recognition among the non-tech business owners and hence a leading market share (in this regard, Stripe is still behind PayPal in terms of the number of websites using their service: Stripe has just over 500k websites using their service whereas PayPal has over 1.3M).

As we will see below, I think the two choices 1)to start at the vertical of payment processing software and 2) to target the web developers is and will continue to be their moat.

As stated, Stripe’s decision to win the minds of the developers is becoming increasingly relevant because individual websites are being consolidated into platforms such as Shopify that offer complex features (such as integrating payment systems, inventory management, accounting…etc) easily accessible to non-tech savvy business owners. In other words, developers of large platforms such as Shopify, are becoming the sole decision-maker on which payment processing software to use for their platform and the business owners are excluded from this decision. Hence, the existing brand awareness and market share, the competitive advantage of PayPal over Stripe, is becoming less significant whereas the developer friendliness, the competitive advantage of Stripe over PayPal, is becoming increasingly important.

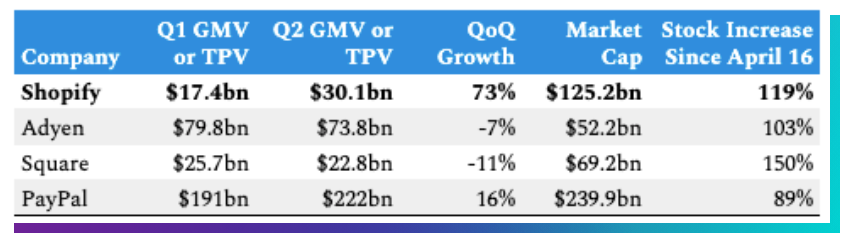

Source: NASDAQ

Consequently, Stripe is likely growing faster than its competitors. Since Stripe is a private company, I don’t have its GMV growth data but we can use Shopify’s number as a proxy for Stripe’s GMV growth because Stripe is heavily reliant on online transactions compared to its competitors. As you can see Shopify grew 73% from Q1 of 2020 to Q2 of 2020 while PayPal grew 16% and Adyen and Square’s GMV dropped.