After speaking to a lot of investors, I have noticed that people are wary of / don’t invest in stocks mostly due to the lack of knowledge, coupled with a subtle fear of making losses. Sadly, they remain aloof to the most prominent investment instrument due to this problem of Cold Start.

If you are such an investor, at the end of this blog post, I can assure you that you will be all-equipped to take your first step towards stock market — be able to select good quality stocks. Will publish a separate post to give you a sample ready-made strategy on how to operate in markets as a long term investor, later.

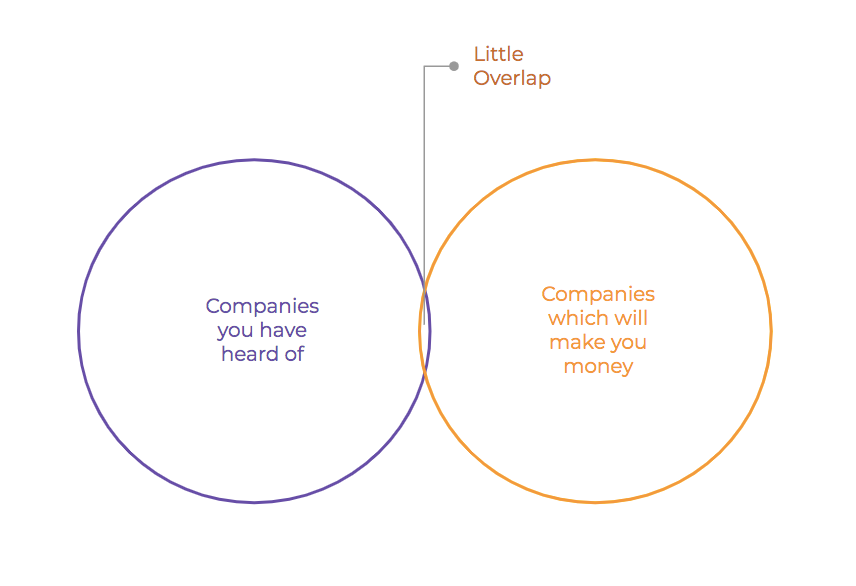

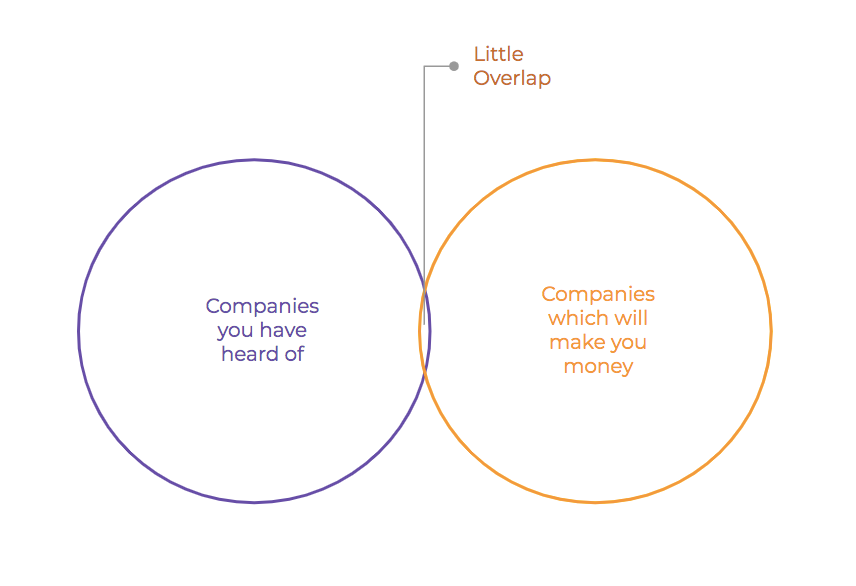

As a matter of fact, I’ve also observed that most new investors start investing in companies they have heard about. But the reality is that the set of stocks which they have heard about and the set of stocks which actually make returns for investors are two different sets, with little intersection between both.

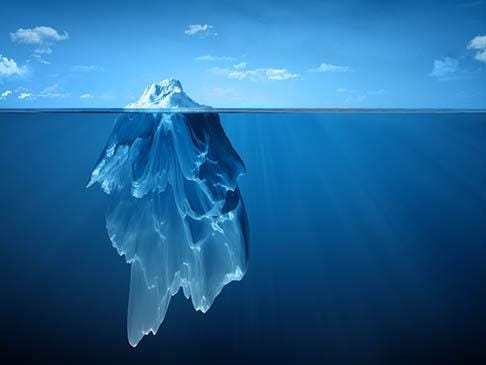

Further, just like an iceberg, the stocks you hear about are probably just 10% of the total stock universe. Mostly this 10% constitutes of B2C firms who generally have a higher visibility amongst general public. But what about the others?

There are 2 kinds of analyses which any investor should do — Fundamental and Technical. In this part, we are going to talk about fundamentals, you can refer to the next part to learn about technical filters and the shortcuts you could apply therein. Though one can argue about the role technicals have to play in a long term investment, I believe that putting up a few technical checks does end up multiplying your returns in a big way.

So let’s talk about the overall strategy you could stick to while selecting stocks. To do that, we’ll have to understand some concepts — Growth and Value.

Let’s say you want an ice cream whose right price is $10. The vendor is asking $12 for it. Will you buy it? No right?

Now what if you get the same ice cream for $8? Will that make you happy?

Buying something which you get at a discount is logical, while vice versa is not. This, precisely, is chasing value. A value investor invests in assets which are available at a discount, not at a premium.

As we’ll see ahead, for a stock, remember that value is not determined by the price of that stock [a mistake most beginners do, they think a stock priced $5000 is more expensive than a stock priced at $10, which is wrong. It doesn’t work that way].

Growth = Expansion. Though growth has many parameters as its constituents, but as a shortcut you could look out for Profit After Tax growth or EPS [Earning Per Share] growth of a firm to get a fair idea.

Growth is typically measured by CAGR, Compounded Annual Growth Rate, typically over the last 3 years, 5 years or 10 years.

Now the ultimate fact is that growth of a company is more or less equal to the return its stock generates — you can verify this from any stock you take as a sample [take this as your homework!]. So if you really want returns, growth becomes the most important thing to look out in a company.

As a category of stocks, Growth Stocks are defined as aligned with our logic: