Gitcoin’s target market is evolving.

In response, Gitcoin is evolving too. Gitcoin’s 3 evolutions are :

Gitcoin’s target market is evolving.

In response, Gitcoin is evolving too. Gitcoin’s 3 evolutions are :

Crypto moves FAST. We are in a rapidly changing ecosystem.

My high level read on the changing market (at least the parts that affect Gitcoin) is:

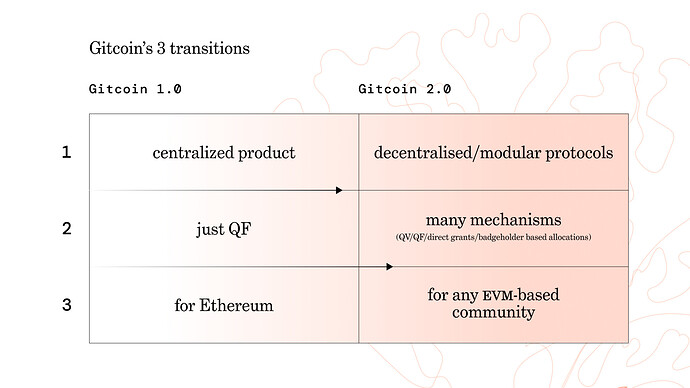

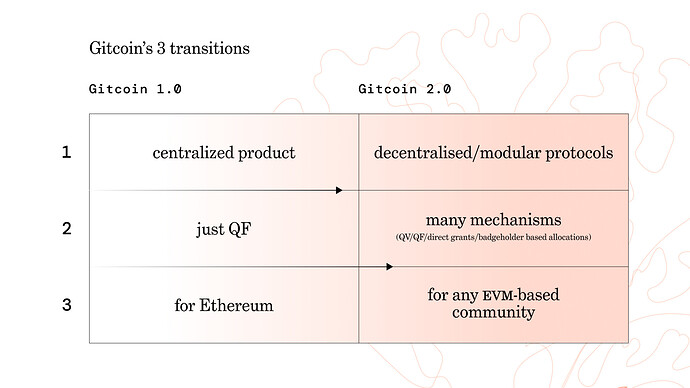

In this post, I would like to articulate 3 transitions that Gitcoin is undergoing which are meant to address the changing landscape.

I think these transitions are:

| Gitcoin 1.0 | Gitcoin 2.0 | |

|---|---|---|

| 1. Architecture | centralized product | decentralized/modular protocols |

| 2. Mechanisms | just QF | many mechanisms (QF/QV/direct grants/many mechanisms) |

| 3. Customer | for Ethereum | for any EVM based community |

The old platform was a centralized monolith that was unforkable + unmaintainable bc it was so large.

The new platform is a suite of decentralized protocols that follow the unix philosophy of doing one thing thing + doing it well. And each protocol has a well designed interface that allows inputs from unforeseen programs.

| Module | One Thing It Does Well |

|---|---|

| Passport | Sybil Resistence |

| Grants Explorer | Browsing Grants |

| Grants Builder | Building Grants |

| Round Manager | Managing QF Rounds |

| Allo Protocol QF Strategy | Quadratic Funding |

| Allo Protocol QV Strategy | Quadratic Voting |

| Allo Protocol x Strategy | Capital Allocation Mechanism x |

If designed well, this ecosystem of tools are “supermodular” - meaning that they produce more value than the sum of their parts. Each new modular added to the ecosystem adds value to rest of the ecosystem.